Can corporate philanthropy solve education inequality?

Wiki Article

The Role of Business Philanthropy in Fostering Sustainable Service Practices

Company philanthropy has become an essential approach for businesses aiming to integrate sustainability right into their procedures. By straightening corporate objectives with social and environmental campaigns, companies can foster healthier environments. This technique not just boosts company credibility however additionally enhances stakeholder connections. The true level of its impact on lasting business success continues to be to be explored. What innovative techniques are being taken on as an outcome?Comprehending Company Philanthropy and Its Importance

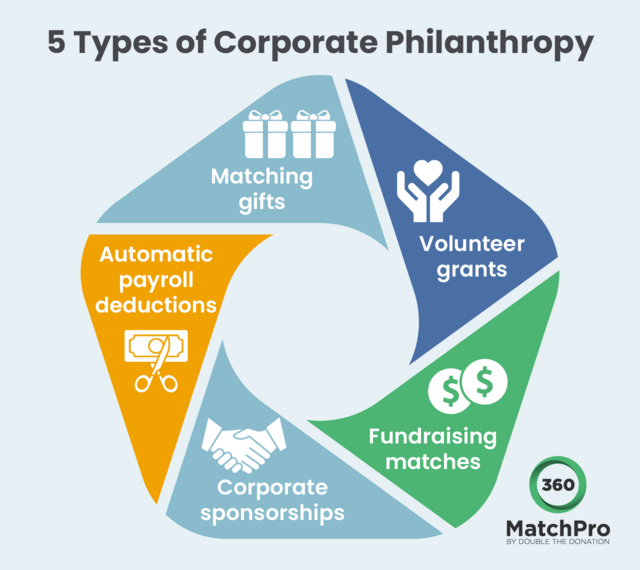

Business philanthropy acts as a vital mechanism with which companies can add to societal health while boosting their very own track records. This method includes organizations allocating sources, such as funds, time, or proficiency, to sustain area efforts, charitable reasons, or social programs. By involving in humanitarian efforts, firms can attend to pressing social problems, such as education, healthcare, and environmental concerns, therefore playing an essential role in fostering favorable change.Business philanthropy can improve worker morale and draw in talent, as people increasingly look for to function for socially accountable companies. It can likewise reinforce client commitment, as consumers favor brands that show a commitment to making a difference. Inevitably, comprehending the relevance of corporate philanthropy depends on recognizing its double benefits: improving community welfare while simultaneously enhancing service trustworthiness and trustworthiness in the eyes of stakeholders. This positioning of social duty with commercial rate of interests emphasizes its significance in today's business landscape.

The Link Between Corporate Philanthropy and Sustainability

While lots of firms take part in philanthropy to improve their public photo, a much deeper connection exists between business philanthropy and sustainability. Business philanthropy usually aligns with sustainable methods by sustaining campaigns that resolve social and environmental difficulties. When organizations buy community projects, sustainable energy, or academic programs, they add to a much healthier ecological community and culture. This commitment not only fosters goodwill but also strengthens stakeholder relationships, enhancing brand commitment.

Case Researches: Successful Corporate Philanthropy Initiatives

Countless firms have successfully incorporated humanitarian initiatives right into their company strategies, showing the concrete benefits of such dedications. Microsoft has released various programs, such as its AI for Planet effort, which sustains environmental sustainability via innovation. This approach not just help preservation initiatives however additionally improves Microsoft's reputation as a leader in business responsibility.Likewise, Unilever's Sustainable Living Strategy highlights social and environmental influence, aligning its philanthropy with business objectives. By funding tasks that improve health and hygiene, Unilever strengthens its brand name while adding to global health and wellness.

Another noteworthy instance is Patagonia, which vows 1% of sales to environmental causes. This dedication reverberates with consumers, cultivating loyalty and driving sales.

These study highlight that effective business philanthropy can produce economic returns while promoting sustainable methods, enhancing the concept that ethical company methods are beneficial for both society and profits.

Building Stronger Stakeholder Relationships With Philanthropy

Philanthropy acts as an essential tool for business seeking to enhance their connections with stakeholders, as it cultivates trust fund and shows a dedication to social responsibility. By engaging in charitable initiatives, companies can link with regional neighborhoods, improving their track record and motivating stakeholder loyalty. This interaction commonly causes purposeful communications, producing a sense of shared values between the company and its stakeholders.Philanthropic efforts can Full Article address particular neighborhood demands, enabling organizations to contribute positively to social challenges. This involvement not only showcases a firm's moral stance but additionally aids in drawing in and keeping customers that prioritize social responsibility.

In addition, staff members commonly feel more determined and engaged when they see their company proactively joining kind tasks, resulting in an extra efficient workplace society. Consequently, company philanthropy ends up being a strategic method for building more powerful, much more resistant connections with varied stakeholder groups.

Measuring the Effect of Company Philanthropy on Company Success

The link in between corporate philanthropy and stakeholder interaction establishes the stage for assessing its influence on total business success. Organizations commonly gauge this influence view it now through different metrics, including brand name online reputation, employee fulfillment, and consumer commitment. Philanthropic initiatives can enhance a company's picture, promoting depend on amongst customers and capitalists alike. Moreover, engaged employees tend to show greater spirits and efficiency, straight associating to enhanced business efficiency.

Quantitative analysis can also be used, with companies reviewing economic returns against humanitarian expenses. Research study suggests that companies with strong kind dedications usually experience greater stock performance and reduced volatility. In addition, qualitative analyses, such as stakeholder comments, can offer insights right into neighborhood perceptions and long-term relational advantages.

Eventually, measuring the influence of business philanthropy requires a multifaceted strategy, integrating both quantitative and qualitative data to guarantee a thorough understanding of its impact on service success. corporate philanthropy.

Frequently Asked Inquiries

Exactly How Can Small Organizations Involve in Corporate Philanthropy Properly?

What Are Common Misconceptions About Company Philanthropy?

Just How Does Business Philanthropy Impact Staff Member Spirits?

Business philanthropy positively influences employee morale by cultivating a feeling of objective, improving task complete satisfaction, and promoting loyalty. Staff members commonly really feel much more involved and motivated when their business adds to social reasons, creating an encouraging workplace.What Are the Tax Benefits of Business Philanthropy for Companies?

Corporate philanthropy supplies significant tax advantages for businesses, including reductions on charitable payments and possible decreases in taxable earnings. These rewards encourage companies to take part in social initiatives while at the same time enhancing their economic standing.How Can Business Choose Reliable Philanthropic Allies?

Companies can choose effective kind partners by assessing alignment with their values, gauging effect potential, examining monetary transparency, and fostering solid communication. This strategic method improves collaboration and assurances shared benefits for both celebrations entailed.Corporate philanthropy offers as an essential mechanism via which services can add to social wellness while enhancing their own online reputations - corporate philanthropy. Ultimately, comprehending the importance of company philanthropy exists in recognizing its twin advantages: improving neighborhood welfare while concurrently boosting company trustworthiness and reliability in the eyes of stakeholders. While several business involve in philanthropy to improve their public picture, a deeper connection exists between company philanthropy and sustainability. The connection in between business philanthropy and stakeholder engagement establishes the stage for examining its impact on overall service success. Company philanthropy uses considerable tax obligation benefits for organizations, including reductions on charitable contributions and potential reductions in taxed earnings

Report this wiki page